the following is a copy of an August 24th letter to clients

- “We had 53 declines in the market of 10 percent or more……That’s once every two years.” – Peter Lynch, on the stock market’s history during the 20th

- On October 9, 2014, the Dow Jones dropped 335 points in one day.

- During the summer of 2011, the S&P 500 dropped over 19% from high to low.

- In 2012, the S&P 500 dropped 9.9% in a short period, keeping it just shy of being called a ‘correction’.

- – -As of this writing on this very volatile morning of August 24, 2015, The S&P has dropped between 7 – 8% since early August.

If you haven’t heard already, you will probably hear of wild rides on Wall Street in the evening news. Yes, it’s been a wild morning, and markets are volatile as we wait to hear more news about whether China will slow down further and for how long.

During these times of uncertainty, we have to remember why we are investors. It is to realize our long term goals, and to maintain the lifestyle we expect and not outlive our money. Whether you are 25, 55 or 85, we have constructed a long term portfolio based upon your needs. With this in mind, here are a few key points to remember with the current market turmoil.

- Trying to time the market– In a very recent article (here),I wrote in part about Market Timing and that it does not work. Despite the boasting of many talking heads on TV and in magazines (they all want to sell their market timing and leveraging systems, after all) there is no evidence of investors who are successful at timing the markets on any consistent basis. In fact, many do worse than those that stay the course. After all, you must be correct on getting in and out over and over again to have success at timing. As we all know the future is unpredictable, especially about where markets will go day to day. The most successful investors use time & discipline to grow their wealth.

- Being well constructed– Having a well-diversified portfolio is important to long term performance and to lessen volatility. Over the past few weeks we have seen the more conservative portions of our portfolios do well, even while world stocks have been faltering, so that balance does pay off. Moreover, So far this year having some exposure to international markets has also helped. Of course, in the past couple of years, that has not been the case, as International has lagged behind the US market; however, we can never be sure what asset class will be the best performer. While the US market has been the out performer the last few years, according to Morningstar, if you were to go out over the longer 15 year period, when you compare the US market [i]versus International markets[ii], International has outperformed the US by an average of about 1.5% per year. We never know where the top performer will be, so our goal is to own a little bit of many asset classes.

- Balancing risk versus reward– There is no such thing as a free lunch. We expect higher long term returns from stock markets precisely because they are volatile. Bonds are less volatile and therefore, we expect lower returns from them over the long run. Cash may be considered safe for the short term, but will produce no growth for long term needs.

- 500 points today does not equal 500 from yesterday– Remember that values have increased over the decades, so while a 500 point drop for the Dow Jones during the crash of 1987 was about a 25% loss, that is only about 2 – 3% today.

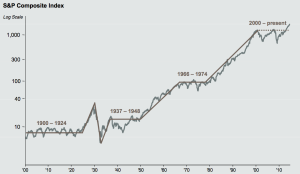

Finally, I want to show a graph of the market since 1900 at the bottom[iii] (If it doesn’t show on your email, it can be seen on the blog website by clicking here).

Even though we have had 2 scary market declines in the past 15 years, as we get farther from them, the two recent crashes seem to fit nicely into an overall historical picture that shows we have always had volatility. We will have it again. We therefore will also expect of our stock investments higher long term returns. We are in it for long term goals!