The horse has left the barn! Close the door!

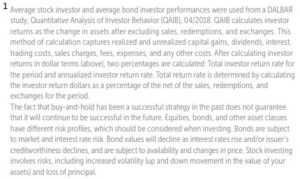

Many investors fail to see market selloffs as an opportunity. In fact they often wait for the market to recover before they invest.

During the market highs last September, I had a conversation with someone who says he wanted to invest money that’s been sitting in cash for the long term.

==>Flash forward to a few weeks ago, while we were in the midst of the most recent selloff, I called him and asked why hadn’t he started his plan? He said that now he was wary of the market selloff. I asked why if he was confident to invest when markets were high, why is he not jumping in when everything is at a 20% discount?

His answer was similar to one I’ve heard for years, and it goes like this. “I want to wait and see what the market does before I get in”

If you were going to purchase a TV for $1000, and suddenly it went on sale, why would you stall and wait for the price to go back up to $1000?

That’s exactly what some investors do when they wait to see what the market will do.

As you’re reading this, you may be thinking, yeah that sounds foolish. And it does, but some of the smartest people I’ve met have fallen victim to this type of investor paralysis. For some reason, when we have a chance to buy a lot more product at a much lower price, the fact that markets may be down scares many of us (admittedly it can worry me too!).

But this is our chance to possibly get great value. Doing the opposite, however, is a great way to buy high and sell low.

You see, as investors, we’re often our worst enemy. When markets go down, we sell, and then we wait until we feel they’re calm again to get back in.

In fact, the picture at the headline of this page from a recent Dalbar Study (1) shows how the average investor well under performs the market because of their actions and inactions. Dalbar surveys have shown this consistently for years. That’s why the Vanguard Study from 2016 shows one of the big value adds of working with a financial planner was their ability to keep you focused on your goals.

In part 2 next week, I will discuss how sitting out during volatile times like last fall ends up hurting investors the most…