Everyone heard the news throughout 2014 that the stock market seemed like it hit new highs almost every day. In the end, it was reported to have risen double digits for the year, but many investors saw only modest gains. What happened to the double digits we heard about and why are they not in my global asset allocation returns? In reality, Markets around the globe were not all that strong. You’ll notice I used the plural ‘markets’.

I am often asked by people, “How’s the market doing today?” I sometimes jokingly retort back, “which market do you mean?”

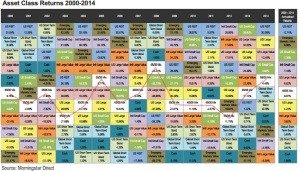

The reality is, when it comes to investing, there are a lot of different markets around the world, and the all can behave quite differently. However, here in America when you hear th e stock market reports on the nightly news or other media, most of the time, they are referring to the Dow Jones or the S&P 500 when they talk about ‘the market’. Those two indexes are comprised of one type of asset class: Large Companies in the United States; however, they are really only a small part of the picture. A well-structured portfolio can include multiple asset classes including small companies in the US, large and small companies in the international developed world, large and small in emerging markets in the under developed world, real estate (which was one of the best performers in 2014 actually) and of course for most investors, especially retirees and near retirees, bonds or fixed income from around the world and more.

e stock market reports on the nightly news or other media, most of the time, they are referring to the Dow Jones or the S&P 500 when they talk about ‘the market’. Those two indexes are comprised of one type of asset class: Large Companies in the United States; however, they are really only a small part of the picture. A well-structured portfolio can include multiple asset classes including small companies in the US, large and small companies in the international developed world, large and small in emerging markets in the under developed world, real estate (which was one of the best performers in 2014 actually) and of course for most investors, especially retirees and near retirees, bonds or fixed income from around the world and more.

Well most of these global asset classes didn’t fare as well as the U.S. large stock market we had heard about in 2014. In fact, many international stock indexes and emerging markets were down considerably for the year, which had a dampening effect on returns for global investors. On the other side of the coin, if you were one of the investors whose investments went up double digits in 2014, or even higher, congratulations, you may have dodged a bullet. However, it is very likely if you did really well last year, you may be at a lot of risk and heavily weighted in only one or two sectors.

So, if International and Emerging markets were dogs last year, why not sell them and move into the stuff that’s been going up? Besides, now all the experts are telling us that The U.S. looks strong and the rest of the world is going to lag? The main reason is that there have been many times that the U.S. has not performed as well as the rest of the world; furthermore, if experts tell us how things look to play out in 2015, check their track record, because nobody knows how markets anywhere will fare, and things can change in an instant. Finally, even though the U.S. Large Market has looked attractive the past few years, according to Morningstar, the 15 year return ending this Dec 31st of the U.S. large stock S&P 500 was only 2.27% per year. (By contrast looking at a global large stock fund, Vanguard’s VHGEX which invests in U.S. and Non-U.S., returned over 7% in the same period according to Morningstar). So being in the one asset that is top of the class this year may not always give you what you want over the long haul.

So while you may be disappointed that all the news was ‘stock market highs’ in 2014, but you had only modest gains, take comfort in the fact that a globally diversified portfolio of multiple asset classes is built for the long term…even if some years you feel like you were left behind.

*Periodic Table courtesy of Morningstar