What happens when you miss the best days?

In part 1, I wrote about how investors wait for some kind of buying signal before investing and how this can lead to significant underperformance. In part 2, I will show why getting out of the market during volatility can also be counter productive.

In reality, it’s not when markets are calm that investors make money. If you want to truly build wealth do these things:

1.) Get in the market.

2.) Stay in the market

3.) keep adding savings into the market.

Oh, and ABOVE ALL…

4.) Don’t try to time the market!

Paraphrasing Warren Buffet, ‘Everyone wants to find out how to get rich quickly, which is a good way to lose a lot of money. One of the most attainable goals in life is to get rich slowly!’

In other words, if you were to invest using mutual funds into a well-balanced, diversified portfolio, there is overwhelming historical evidence that in a long time period (20+ years) your investment would have increased a great deal, no matter what time period you began.

In short, it’s not timing, it’s time in (the market)

However, at times like the market sell off, investors often get worried and sell only after stocks go down. We see increased outflows from funds during down periods, and they can pickup steam the farther markets decline. Then investors try to wait for a good time to get back in, which by most definitions occurs only after they observe the market going back up.

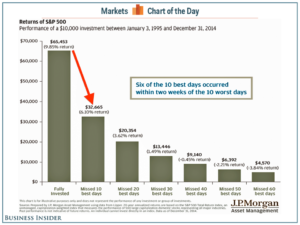

Want to see what timing the market does? Below is a graph from the last 20 years on what would have happened if you were out of the stock market for only a small fraction of the time. Conclusion: If you remained invested, you earned an almost 10% average annual rate of return. On the other side, If you missed only the best 40 days (out of about 5000 trading days) you instead had a 20 year negative return!

Sitting out during times of big market swings is also not a solution. In fact, some of the market’s biggest positive days have occurred during times of down markets and bad economies. If we get out at the first since of choppy markets, we can easily miss the upside. Like I said in the last article; closing the barn door once the horse has left

So staying put is the best thing option.

Looking at an example, what would have happened if you had invested $10,000 in a balanced fund such as Dimensional Funds Global Allocation 60/40 fund (DGSIX) on September 14th, 2008, the day BEFORE Lehman brothers collapsed during the great recession selloff (the worst possible time to invest in the last generation)?

According to Morningstar, ten years later on September 13th, 2018 that $10,000 would have been worth $19,487!

Nearly double in ten years! And this results from investing the day BEFORE the collapse!!

We never know what markets will do in the short term, but getting rich slowly can work if you are in for the long term.

So if you’re invested in a well built portfolio, stay put & keep saving on a regular basis.